(Bloomberg) — Stocks took a breather after notching their longest weekly rally this year, with traders gearing up for key earnings reports from Boeing Co. to Tesla Inc. and United Parcel Service Inc.

Following a relentless advance to all-time highs, equities dropped from nearly overbought levels. In another sign of how the market has been stretched, the S&P 500 has gone about 30 sessions without suffering back-to-back losses. While a month with no consecutive down days may not sound like much, the current streak ranks among the very best since 1928, according to data compiled by SentimenTrader.

“The index remains overbought across multiple time frames and is still vulnerable to profit-taking over the short run,” said Dan Wantrobski, director of research at Janney Montgomery Scott.

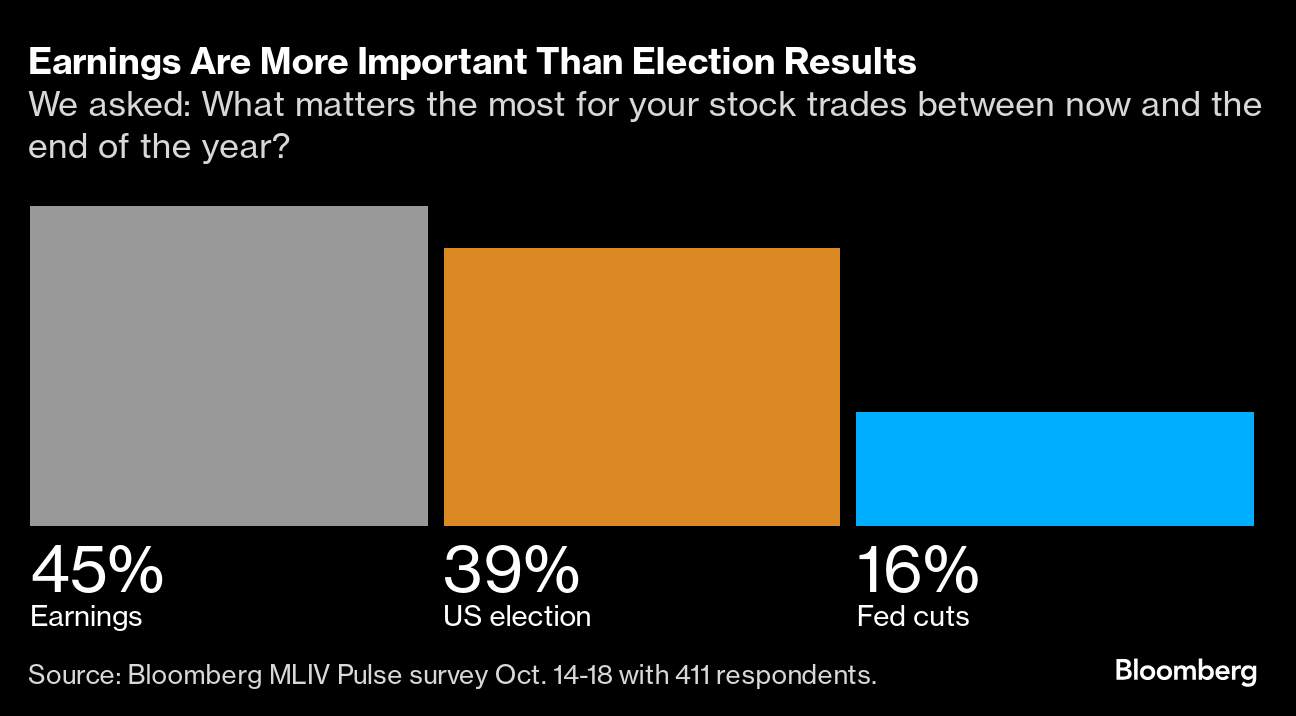

Wall Street faces a big earnings hurdle this week, with roughly 20% of the S&P 500 companies scheduled to release results. The latest Bloomberg Markets Live Pulse survey shows respondents see Corporate America’s results as more crucial for the equity market’s performance than who wins the November election or even the Federal Reserve’s policy path.

The S&P 500 fell 0.3%. The Nasdaq 100 was little changed. The Dow Jones Industrial Average slid 0.8%. The Russell 2000 retreated 1.5%. Homebuilders tumbled. United Parcel Service Inc. sank 3% on a sell recommendation at Barclays Plc. Most megacaps retreated, though Nvidia Corp. headed toward a record high. Boeing Co. rallied 2.7% after a tentative agreement with its union.

Treasury 10-year yields advanced nine basis points to 4.18%. The chances that Fed officials will leave rates unchanged in November are mounting as the US economy powers ahead, according to Torsten Slok, chief economist at Apollo Management. Swaps traders are pricing 20 basis points of easing next month, below a full quarter-point.

Oil climbed as China moved again to bolster its economy and traders tracked the risk to supplies from tensions in the Middle East.

During this particular earnings season, there are some other key issues that could/should also play an important role in how the stock market acts over the next few weeks, according to Matt Maley at Miller Tabak.

“The presidential election is now just two weeks away, and it is quite evident that Israel is going to strike back at Iran at some point in the near future,” he said. “If you look at the price of gold and at the elevated level of the VIX, you can see that investors are buying some protection against any new negative developments from these three areas.”

Jeffrey Buchbinder at LPL Financial says the bar for third-quarter earnings is low, with analysts currently expecting only about a 3% increase in S&P 500 earnings per share.

“That low bar and a supportive economic environment points to potential upside,” he said. “However, stocks may already be pricing in solid results.”

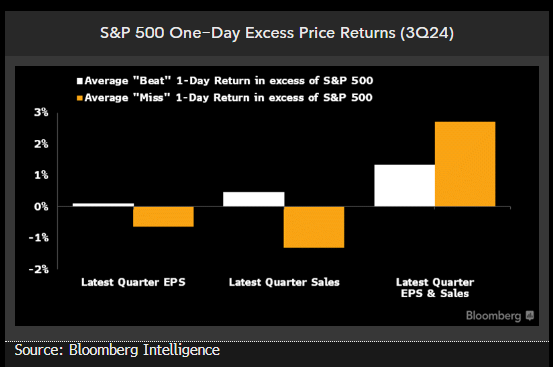

Companies in the US benchmark gauge that have beaten profit estimates so far this season are being rewarded “more significantly” compared with the previous four quarters, according to Morgan Stanley strategists led by Michael Wilson. They also noted that the revisions breadth for 2025 is “significantly outperforming” seasonality.

“As is typical, the early days of earnings season are sparking relatively strong price reactions,” said Bloomberg Intelligence strategists Gina Martin Adams and Wendy Soong. “Both beats and misses are resulting in bigger-than-usual price moves.”

Stocks that surpassed third-quarter earnings or revenue estimates — or both — recorded an average one-day excess return to the index of 2.1%, 2.3% and 2.6%, more than double the longer-term average (for whole earnings seasons), they said. Misses are likewise resulting in steeper selloffs of 3.8%, 2% and 3.7%, BI said.

This week, Tesla will likely face questions during its earnings call on production targets and regulatory challenges after the unveiling of its much-hyped Cybercab failed to enthuse investors and quell concerns over its recent vehicle sales. Boeing will also have to mollify investors increasingly concerned over production delays, labor strife and depleted financial resources.

Reports from UPS, Norfolk Southern Corp. and Southwest Airlines Co. should reveal the combined impact of Hurricane Helene and the three-day East Coast dockworker strike on the recent quarter.

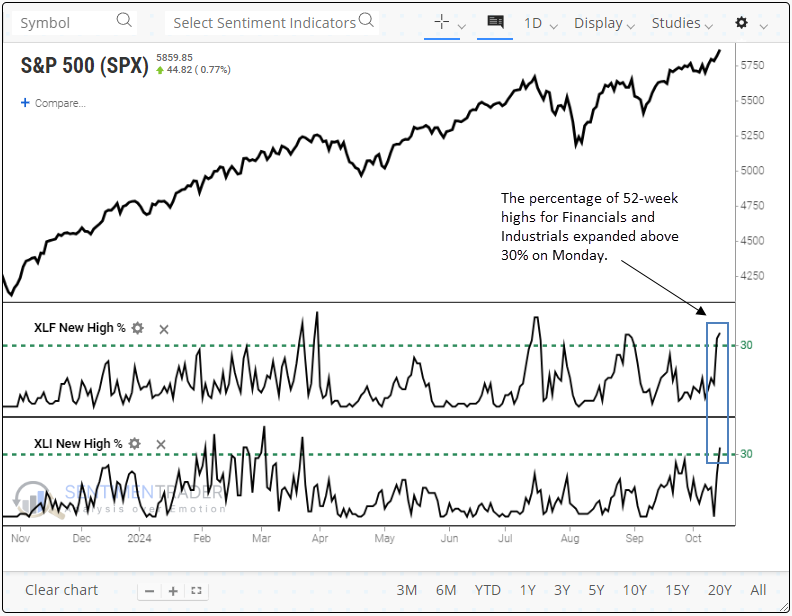

After the S&P 500 Index logged 47 closing records this year, some on Wall Street are worried that the equity benchmark will lose ground. But a number of market breadth measures — with perfect track records — suggest investors should position for further gains in 2025.

Nearly one third of stocks in the S&P financial and industrial sectors notched a 52-week high last week.It’s rare to see so many equities peaking at once in those groups. In the 20 other instances that’ve occurred since 1954, the broader US stock benchmark has risen in the following year 100% of the time, according to an analysis from SentimenTrader.

“We believe there is continued upside ahead for stocks, especially now that we are entering a seasonally strong period of the year for markets, with November and December historically being good months for stocks,” said David Laut at Abound Financial. “The stock market may be due for a bigger pullback of greater than 15% in 2025, as we have yet to see a pullback of that magnitude since this bull market was born over two years ago.”

Although the market has shown incredible resilience this year, with nine out of 10 positive months, we’re beginning to see parallels with the 2001–2006 period where tech valuations were high, according to Mark Hackett at Nationwide.

“Unlike the dot-com bubble, today’s leading tech firms have solid fundamentals, but the market is far from ‘normal’,” he noted. “High expectations are warning signs for potential instability in the next few years. Investors should prepare for moderating returns and volatility, especially as cracks begin to appear beyond 2024.”

US stocks are unlikely to sustain their above-average performance of the past decade as investors turn to other assets including bonds for better returns, according to Goldman Sachs Group Inc. strategists including David Kostin.

The S&P 500 is expected to post an annualized nominal total return of just 3% over the next 10 years, they said. That compares with 13% in the last decade, and a long-term average of 11%.

“Investors should be prepared for equity returns during the next decade that are toward the lower end of their typical performance distribution,” the team wrote in a note dated Oct. 18.

Corporate Highlights:

- Spirit Airlines Inc. soared after the struggling carrier reached an agreement with US Bank National Association extending a key deadline to restructure debt.

- Walt Disney Co. named James Gorman chairman of the board and said it will appoint a new chief executive officer in early 2026.

- Microsoft Corp. is launching a set of artificial intelligence tools designed to send emails, manage records and take other actions on behalf of business workers, expanding an AI push that intensifies competition with rivals like Salesforce Inc.

- Kenvue Inc. rallied after activist investor Starboard Value took a stake in the Tylenol maker with an eye toward making changes to boost the company’s stock price.

- One of Kering SA’s longest-standing bulls has thrown in the towel, dealing another blow to the Gucci-owner just days ahead of a sales update. Citibank Inc. downgraded the stock to neutral, removing a buy rating it has held for more than a decade, according to data compiled by Bloomberg.

- Investment firm JAB agreed to acquire Mondelez International Inc.’s stake in JDE Peet’s NV for €2.16 billion ($2.3 billion), increasing its control over the struggling coffee maker as its shares trade near all-time lows.

- Ping An Insurance (Group) Co. said profit jumped 36% for the first nine months of the year, after a stock-market rally bolstered investment returns at China’s second-largest insurer by market value.

Key events this week:

- ECB’s Christine Lagarde is interviewed by Bloomberg Television, Tuesday

- BOE’s Andrew Bailey as well as ECB’s Klaas Knot and Robert Holzmann to speak at Bloomberg Global Regulatory Forum in New York, Tuesday

- Philadelphia Fed President Patrick Harker speaks, Tuesday

- Canada rate decision, Wednesday

- Eurozone consumer confidence, Wednesday

- US existing home sales, Wednesday

- Boeing, Tesla, Deutsche Bank earnings, Wednesday

- Fed’s Beige Book, Wednesday

- US new home sales, jobless claims, S&P Global Manufacturing and Services PMI, Thursday

- UPS, Barclays earnings, Thursday

- Fed’s Beth Hammack speak, Thursday

- US durable goods, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.3% as of 2:17 p.m. New York time

- The Nasdaq 100 was little changed

- The Dow Jones Industrial Average fell 0.8%

- The MSCI World Index fell 0.5%

- Bloomberg Magnificent 7 Total Return Index rose 0.3%

- The Russell 2000 Index fell 1.5%

Currencies

- The Bloomberg Dollar Spot Index rose 0.4%

- The euro fell 0.5% to $1.0816

- The British pound fell 0.5% to $1.2986

- The Japanese yen fell 0.8% to 150.77 per dollar

Cryptocurrencies

- Bitcoin fell 2.2% to $67,254.68

- Ether fell 1.8% to $2,662.21

Bonds

- The yield on 10-year Treasuries advanced nine basis points to 4.18%

- Germany’s 10-year yield advanced 10 basis points to 2.28%

- Britain’s 10-year yield advanced eight basis points to 4.14%

Commodities

- West Texas Intermediate crude rose 1.8% to $70.49 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

©2024 Bloomberg L.P.