Slash Exploration Ltd. has retained EnergyNet for the sale of working interest participation in the Capitan 22301 27-22 State Com #20H wellbore in Lea County, New Mexico.

The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

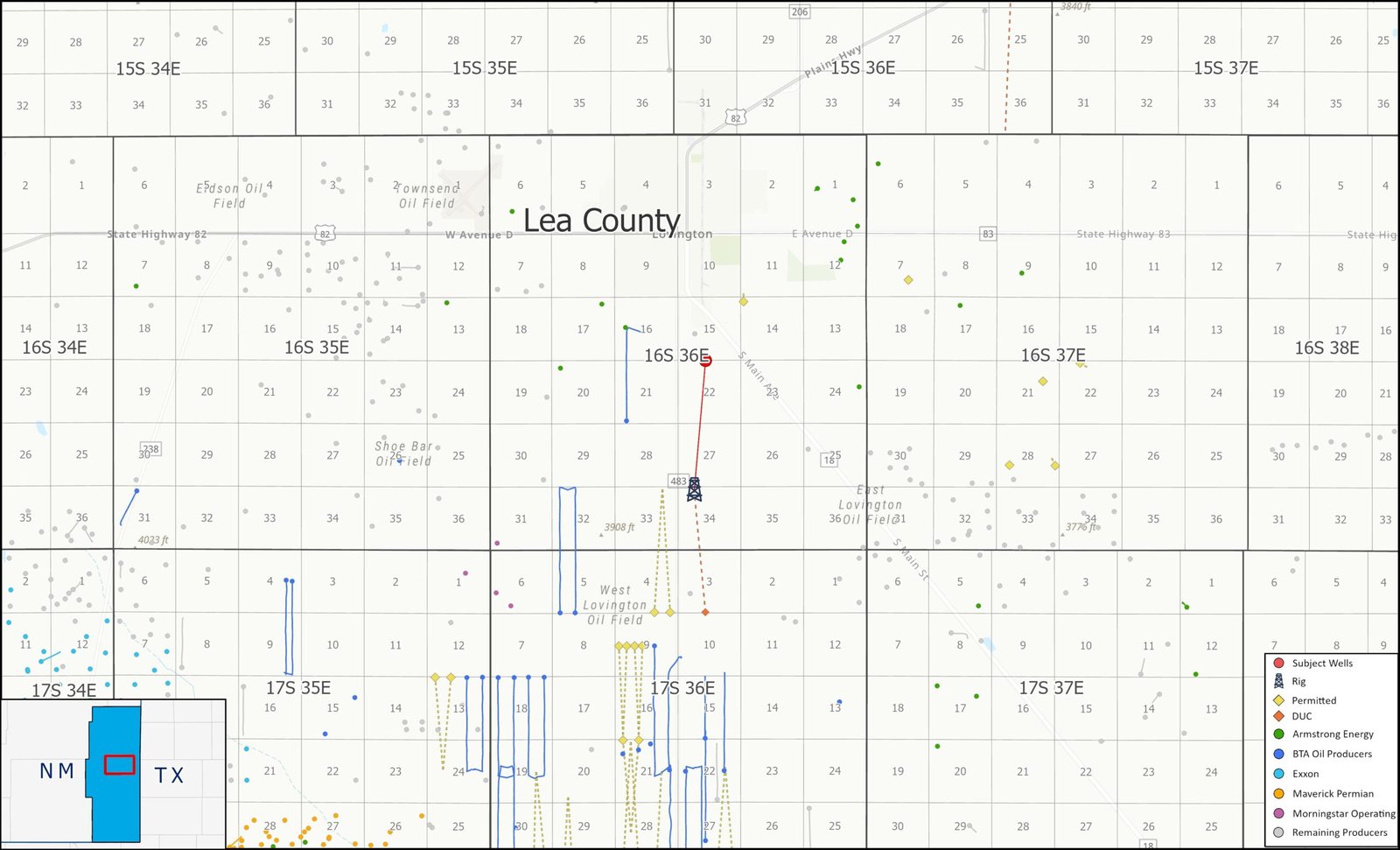

Slash Exploration Ltd. has retained EnergyNet for the sale of working interest participation in the Capitan 22301 27-22 State Com #20H wellbore in Lea County, New Mexico. The Lot # 121107 package includes 10% working interest.

Opportunity highlights:

- WI Participation in the Capitan 22301 27-22 State Com #20H Wellbore:

- 10.00% WI / 7.50% NRI

- Seller will accept offers up to and including the full WI being offered

- Projected Formation: Pennsylvania Shale

- Total Participation Cost: $1,232,865.30

- 10.00% WI / 7.50% NRI

- Seller has Elected to Participate

- Operator: BTA Oil Producers

- Offset Activity:

- 1 Rig

- 2 DUCs

- 28 Permits

- Select Offset Operators:

- Armstrong Energy

- Exxon

- Maverick Permian

- Morningstar Operating

Bids are due Dec. 19 at 4 p.m. CST. For complete due diligence, please visit energynet.com or email Zachary Muroff, managing director, at Zachary.Muroff@energynet.com, or Krystin Gilbert, buyer relations manager, at Krystin.Gilbert@energynet.com.

Recommended Reading

Oil Prices Jump 4% on US Storm, Israel-Iran Fears

2024-10-10 – Oil prices jumped about 4% on Oct. 10 on a spike in U.S. fuel use before Hurricane Milton barreled across Florida, Middle East supply risks and signs that demand for energy could grow in the U.S. and China.

What’s Affecting Oil Prices This Week? (Sept. 30, 2024)

2024-09-30 – Based on Stratas Advisors’ demand forecast, there is room for Saudi Arabia to increase supply gradually and not collapse oil prices — if there is no dramatic increase in non-OPEC supply and the other members of OPEC+ do not grossly exceed their quotas.