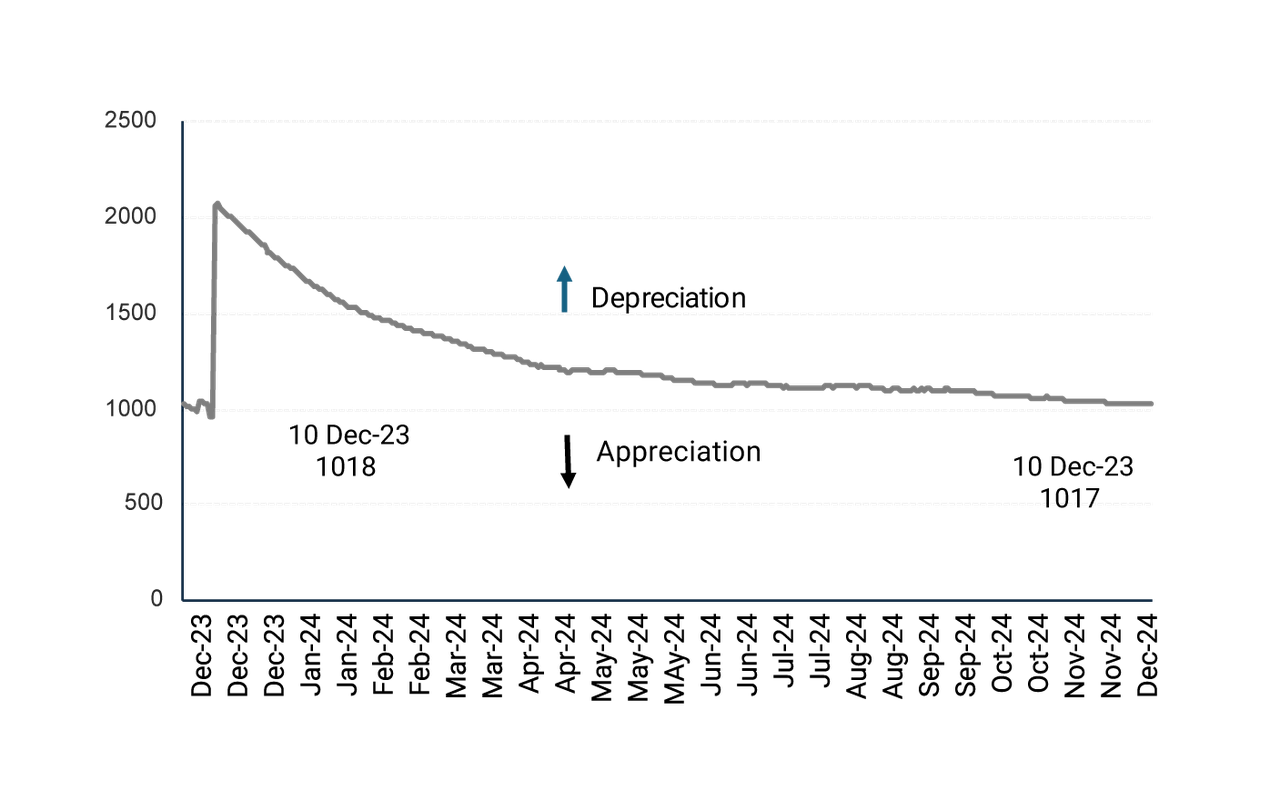

Thus, the peso’s appreciation isn’t driven by improved competitiveness but by speculative carry trade operations. The government’s firm commitment to a two percent monthly depreciation to the US dollar, coupled with a new tax amnesty, has lured Argentines to pull greenbacks from their dollar-stuffed mattresses to invest in pesos. However, this strategy hinges on short-term profits. At the first whiff of a peso devaluation, these investors are likely to revert to their trusted greenbacks.

Fully aware of the risks, and with the central bank’s still negative reserves, Argentina’s finance minister, Luis “Toto” Caputo, has chosen to maintain the capital outflow restrictions inherited from the previous left-leaning Peronist administration. However, Caputo knows that curving inflation may not suffice to convert Milei’s current political popularity into a win in October 2025 legislative elections. Economic stabilization alone might not outweigh rising concerns about unemployment and poverty.

Milei’s fiscal rigour initially deepened Argentina’s recession, intensifying Argentines’ anxiety over unemployment and poverty. While the economy is beginning to show signs of recovery, sustaining the momentum will require attracting investment in job-creating industries. Yet capital controls remain a stumbling block, deterring investors who want to be reassured that their capital can exit as easily as it enters.

However, lifting these controls under an overvalued peso could reignite Argentines’ enduring love affair with the US dollar, potentially triggering a sharp devaluation that could wake up Argentina’s inflationary reflexes.

This is when the IMF and the illusion of a Trump-engineered bailout enter the picture. Caputo is knocking at the IMF’s door for fresh funds to shore up reserves and enable a smooth transition to a floating peso. However, the IMF is unenthusiastic about allowing Argentina to use its dollars for propping up an overvalued peso.

Milei is betting on his influential ally. While the United States holds the largest sway at the IMF, the fund is not a US government agency. EU countries collectively control 30 percent of voting power, and Milei’s vocal backing of Europe’s far right and his hint at pulling Argentina out of the 2015 Paris Agreement could complicate Trump’s efforts to sway the fund. Overcoming the IMF’s technical reservations about Argentina’s exchange rate policy will demand more than just Trump’s influence.

Moreover, given Trump’s transactional instincts, Milei’s pledge of loyalty to the United States may not be enough. Securing Trump’s support may come at a price.

Argentina sits uncomfortably with Mercosur, the South American customs union led by Brazil. Milei has recently called it “a prison” and is pushing for a bilateral free trade agreement with the United States, a move that could imply dismantling Mercosur. This would directly undermine Brazilian President Luiz Inácio Lula da Silva, who is spearheading efforts to create a BRICS (Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran and the United Arab Emirates) currency to challenge the US dollar. Trump, who has threatened

100 percent tariffs in retaliation, might see weakening Lula — and, by extension, the BRICS bloc — as a strategic win.

This article was originally published by the Official Monetary and Financial Institutions Forum.