Storage tanks at the Midway-Sunset Oil Field near Derby Acres, California, U.S., on Friday, April 29, 2022. Oil is poised to eke out a fifth monthly advance after another tumultuous period of trading that saw prices whipsawed by the fallout of Russia’s war in Ukraine and the resurgence of Covid-19 in China. Photographer: Ian Tuttle/Bloomberg

(Bloomberg) — Oil steadied ahead of US economic data, as the market seeks a catalyst to break out of the tightest trading range in over three years.

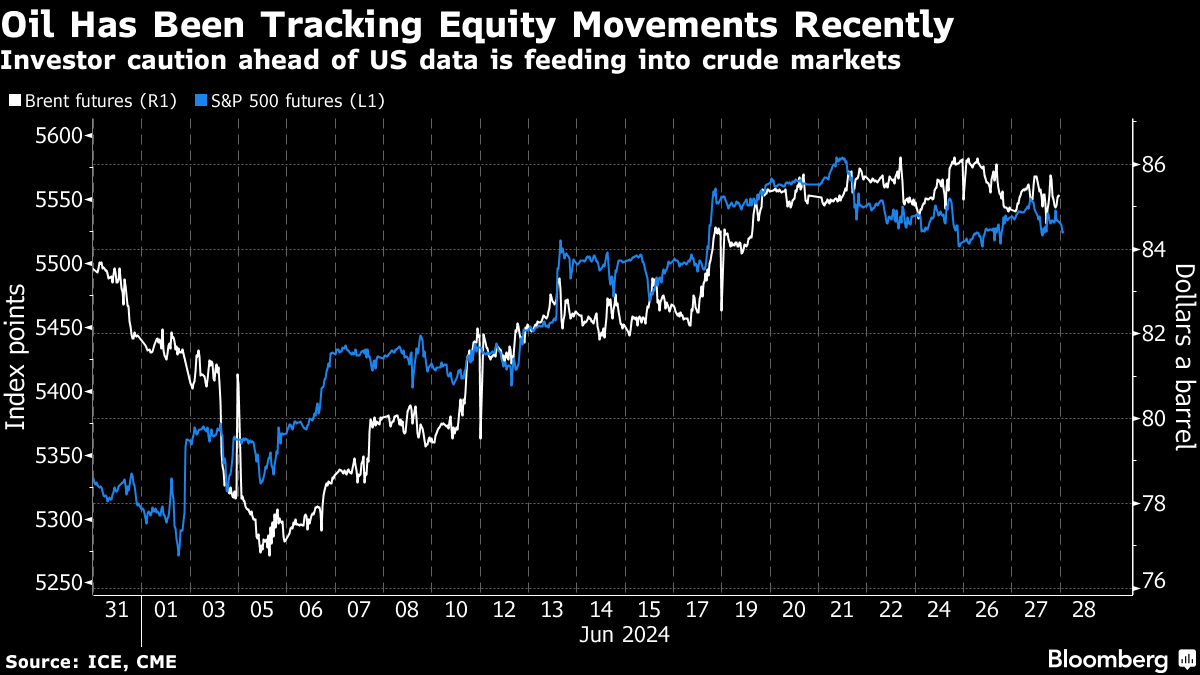

Brent traded near $85 a barrel and has swung in a narrow range of $1.76 so far this week, the smallest fluctuation since early 2021. Traders are watching for a range of US economic data over the next two days, including employment figures, which could set the tone for oil and broader markets.

Even an unexpectedly large build of US crude stockpiles failed to ignite stronger price moves on Wednesday, with West Texas Intermediate closing little changed. The benchmark was below $81 a barrel on Thursday.

Oil is on track for a monthly gain and there are expectations prices will climb further over the next quarter on seasonal strength. Futures have taken their cues from the moves of wider stock markets recently, and the outcome of upcoming elections in Iran and France could add further volatility.

“Signals on demand remain mixed, but are generally positive given summer travel and cooling demand,” said Charu Chanana, market strategist for Saxo Capital Markets Pte in Singapore.

US Gulf Coast crude inventories ballooned by 2 million barrels last week and remain at the highest since 2020 on a seasonal basis, while overall stockpiles are the biggest since April. There are signs of lackluster fuel consumption, with measures of gasoline and jet fuel demand flagging.

©2024 Bloomberg L.P.

By Yongchang Chin

Related articles

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Top China Lithium Firm Files International Claim Against Mexico

Jun 24, 2024

Oil Holds Decline as Risk-Off Tone Vies With Attacks on Ships

Jun 24, 2024

Brazil Is Oil Market Wildcard After Near-Million-Barrel Plunge

Jun 22, 2024

Oil Rally Fizzles After Futures Cross Into Overbought Territory

Jun 21, 2024

July Fourth Travel Seen Hitting Record in Boost for Oil Bulls

Jun 20, 2024

Oil Holds Advance as Risk-On Mood Eclipses US Stockpile Build

Jun 19, 2024

Vitol Is Said Among Bidders for Venezuela-Owned Citgo’s Parent

Jun 18, 2024

Oil Builds on Weekly Gain as Traders Bet on Summer Demand Growth

Jun 17, 2024

Niger Stops Oil Exports Through Benin Over Border Feud

Jun 15, 2024

US Edged Out by Brazil Beef Fat Destined for Biofuels

Jun 14, 2024