After the election, the punditosphere was filled with opining about what Trump’s election meant for oil prices, with many noting historical trends suggested Republican presidents were generally bearish for oil, Democrats bullish. But that involves a pretty small sample size, with only prior 11 presidents since 1973, and for the most part, outside factors have been more important than U.S. policy. Arguably, Nixon’s price controls and Carter’s slow unwinding of them contributed to the 1979 price spike, but U.S. energy policy had little impact on the Iranian Revolution. Reagan’s oil price decontrol was certainly beneficial to the industry and the economy overall, but didn’t have much impact on world oil prices: prices fell in 1985 because they were unsustainably high.

On the other hand, Republican presidents have tended to be more pro-business and less inclined to denounce ‘Big Oil’ than Democrats, even if that hasn’t always translated into strong pro-oil policies. Easier leasing on federal lands occurs when Republicans are in office, on the other hand, Republican governors in California and Florida have typically sided with opponents of offshore drilling, not out of conviction but populism.

Politicians and the media are co-dependent in their addiction to handicapping horse races, in this case over the responsibility for oil price trends. Politicians have always sought to take blame for favorable trends, such as strong employment or stock market prices, while denying blame for when the reverse occurs. Higher egg prices demonstrates this very well, since avian flu and the culling of infected flocks are the prime driver, but that hasn’t stopped efforts to assign responsibility. While it is true that most of the culling occurred under Biden, he didn’t ‘kill’ the birds himself (imagine Joe Biden as Rambo, assaulting a poultry farm), and Trump can do little to reduce egg prices. (Picture RFK, Jr. lecturing chickens on the safety of vaccines.) Keynes once said we’re all slaves to the ideas of dead economists, and a corollary to that would be that our omelets are slaves to dead poultry.

Oil is a more mixed case, as politics often affect—but rarely determine—the world price. The Trump Administration’s slogan ‘drill, baby, drill,’ is little more than posturing: he will no doubt take steps that the industry favors, but they aren’t going to commit billions of dollars to upstream investment just to please him. Deregulation should lower costs somewhat, but overwhelmingly, the world price of oil determines the level of drilling in the shale patch.

The bulk of the Administration’s power over oil prices instead revolves around its foreign policy and especially the degree to which it enforces sanctions on Iran, Russia and Venezuela, although the last involves only minor amounts of supply. The toughening of sanctions on Iran, and threat to do so for Russian oil, could remove a significant amount of supply from the market, in theory up to one million barrels a day. Alternatively, new agreements with either country—whose timing is unpredictable—could mean more oil and lower prices.

But there’s one effect that is still looming over the industry like a sword of Damocles: a recession brought about by economic uncertainty. Businesses of all stripe crave stability and that seems to be lacking at present given recent Administration moves (and threats). First, aside from the negative impacts on many of tariffs, constantly changing tariff implementation and levels make businesses prone to hesitate on purchases and investments, which could slow economic activity. And while the planned reduction of the federal work force might seem minor on the national level, many other employees have to consider their jobs threatened, which will cause them to delay purchases. Also, organizations that have contract cancelled or payments stalled will create a ripple effect beyond those immediately affected.

This is reflected in the plummeting consumer confidence indices, including The Conference Board’s Expectations Index, which in February dropped to 72.9, below the 80 level thought to presage a recession. Obviously, it is imperfect in its ability to predict the size or time of recession, but it is highly suggestive of consumer spending.

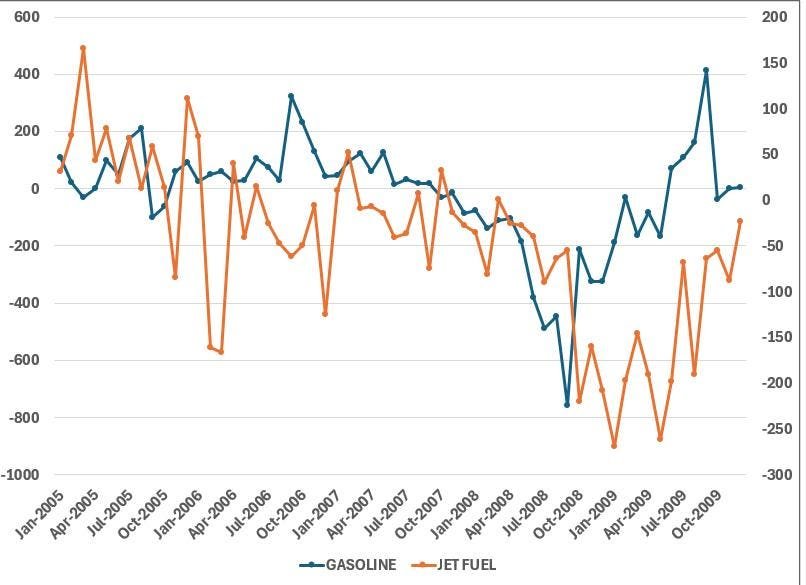

Interestingly, the Administration is not downplaying the impact of all this uncertainty but rather warning that some short-term pain will be worth the long term gains. Regardless of whether that proves true, the growing uncertainty is likely to affect this summer’s vacation plans for many Americans. Long-distance vacations are not essential expenditures and it seems increasingly likely that summer travel this year will be anemic, lowering oil demand in what was labelled ‘staycations’ back in 2008. Then, gasoline prices over $5/gallon meant that many chose local vacations, which, as the figure below shows, lowered gasoline demand by over 4% or 400 thousand barrels a day compared to year-earlier levels.

Year-on-year Oil Demand 2008 (tb/d)

At present, the official forecast of the Energy Information Administration shows no major change in gasoline consumption this year or next (see figure below), primarily because official groups like the EIA, the IEA and OPEC tend to be conservative, incorporating economic weakness after it has occurred, not before. Shrinking consumer confidence will surely reduce vacation spending and lower gasoline demand, but probably not to the degree seen in 2008. Still, as OPEC+ unwinds its voluntary production cuts and if sanctions don’t reduce Iranian and/or Russian oil exports, this summer will see oil prices under pressure again.

Gasoline, Actual and EIA Forecast (mb/d)

While this would be bearish for oil prices in theory, the reality depends on both the Administration and, more important, OPEC+. The Administration would probably not react to lower oil prices except to take credit for assisting consumers, but what ultimately happens depends on OPEC+. If oil prices continue to weaken, OPEC+ might very well pause the unwinding of the voluntary production cuts and stabilize them, albeit probably at a lower level than last year’s. At any rate, the industry is definitely wise to exhibit caution in their drilling and investment plans until the picture clarifies. Given today’s egg prices, it is clearly wise to not count your chickens before they hatch.