By John Richardson

I REST MY CASE! When I was writing this blog 24 hours ago, I wrote the following intro section in italics below:

WATCH OUT for those who will claim that they know the final outcomes of President Trump’s decision to impose additional tariffs on imports from Canada, Mexico and China.

Just in case you have just returned from a vacation to Mars, here is a reminder of what’s happened: The president, using executive orders, has announced 25% extra tariffs on most goods from Canada and Mexico with a10% additional tariff targeting Chinese imports. Sure, the size and speed of the tariffs have taken people by surprise, But, in my view, nothing has changed over the last couple of days.

We remain entirely in the dark over whether the new White House administration will negotiate, compromise, and adapt its approach to tariffs based on the “Art of the Deal”. Could pressure from rising US inflation and declining stock markets also play a role? Or will the Trump presidency continue down the current path?

How will Canada, Mexico and China respond? We again simply don’t know beyond their initial retaliatory tariffs. Their potential responses create a range of scenarios as to how the Trump presidency could react. Specifically on China, should we read anything into its calm reaction to the new tariffs relative to Canada and Mexico? Perhaps. Perhaps not as this is early days.

What we can still say is that you need to build scenarios for anything from an improved US-China trading relationship to a trade war worse than in 2018 to anything in between these two extremes. I will of course be accused of sitting on the fence. But it is better to sit on the fence than to be so entrenched in one camp that you don’t have alternative scenarios in place to respond when events don’t follow the pattern you had expected.

Then I woke up this morning, Asian time, this news from The Financial Times:

Trump Backs Away from Tariffs (For Now)

- Initially planned major tariffs on Canada and Mexico but reversed course after diplomatic negotiations.

Canada & Mexico Strike a Deal to Avoid Tariffs

- Agreed to deploy 10,000 troops at their borders with the U.S. to combat illegal immigration and drug trafficking.

- Won a 30-day reprieve from tariffs, which could have disrupted hundreds of billions of dollars in annual trade.

Canada’s Additional Commitments

- C$200 million ($138.56 million) in funding for fighting organized crime and fentanyl trafficking.

- Appointment of a “Fentanyl Czar” to oversee anti-drug efforts.

A reminder for the shifts in U-China HDPE and LLDPE trade

What we do know is that an improved overall trading relationship between the US and China was a factor behind big gains for the US in HDPE and LLDPE in 2022-2024 (the three years after the end of the Chemicals Supercycle) versus 2019-2021 (the three years immediately before the end of the Supercycle). As a reminder of my posts over the last two weeks:

- HDPE imports by China soared from the US soared by 120% to 1.8m tonnes in 2022-2024 from 0.8m tonnes in 2019-2021. Meanwhile, Saudi Arabia was among the losers as its imports fell by 40% to 3.2m from 5.4m tonnes.

- When these two three-year periods were again compared, US HDPE sales turnover in China rose by nearly one billion dollars. Saudi Arabia’s turnover was down by $2.3bn. Iran was 1.8bn lower and South Korea 0.52bn lower.

- China’s LLDPE imports from the States jumped by 190% to 3.1m tonnes as imports from most of its other top ten trading partners declined. For example, imports from Iran were down by 40% at 575,665 tonnes with imports from Thailand 22% lower at 1.7m tonnes.

- US LLDPE sales turnover in China increased by $2.3bn while most of China’s other top ten trading partners saw declines in their turnovers. Thailand saw the biggest decline at $519m followed by Iran at $418m and Singapore at $314m.

As mentioned, the better overall US-China trading relationship – which led to lower Chinese effective tariffs on US HDPE and LLDPE – seems to have factor behind these extraordinary numbers. As my colleague Joe Chang wrote in this July 2024 ICIS news article:

After the US imposed major tariffs on Chinese imports in several rounds in 2018 and China responded with retaliatory tariffs, including on key chemicals and plastics such as PE, one would have expected US exports to China to have fallen.

And indeed, there was a chilling effect early on.

“ICIS models indicate that the PE import tariffs reduced US PE destined for China by roughly 41% in 2019,” said Harrison Jacoby, director of PE at ICIS.

“If that were to happen today, it would be just over 1 million tonnes which is about 9% of overall US PE exports,” he added.

Why did US PE exports to China later surge after the retaliatory tariffs were in place?

First, there were tariff rollbacks by the US as well as China by December 2019 on the striking of a trade deal. Many tariffs remained in place, though at lower rates.

Then critically in February 2020, China offered importers waivers on certain tariffs imposed on US PE and other plastics and chemicals imports.

For various types of US HDPE and LLDPE, on which a 34% tariff rate applied, Chinese importers could apply for a waiver and instead pay the pre-trade war duty of 6.5%

But the big gains the US made may have also been the result of feedstock advantages and perhaps (this is just a theory I’ve heard discussed), the US being better able to supply higher-value grades to China than its competitors. China is becoming increasingly self-sufficient in commodity grades of HDPE, LLDPE and other polymers.

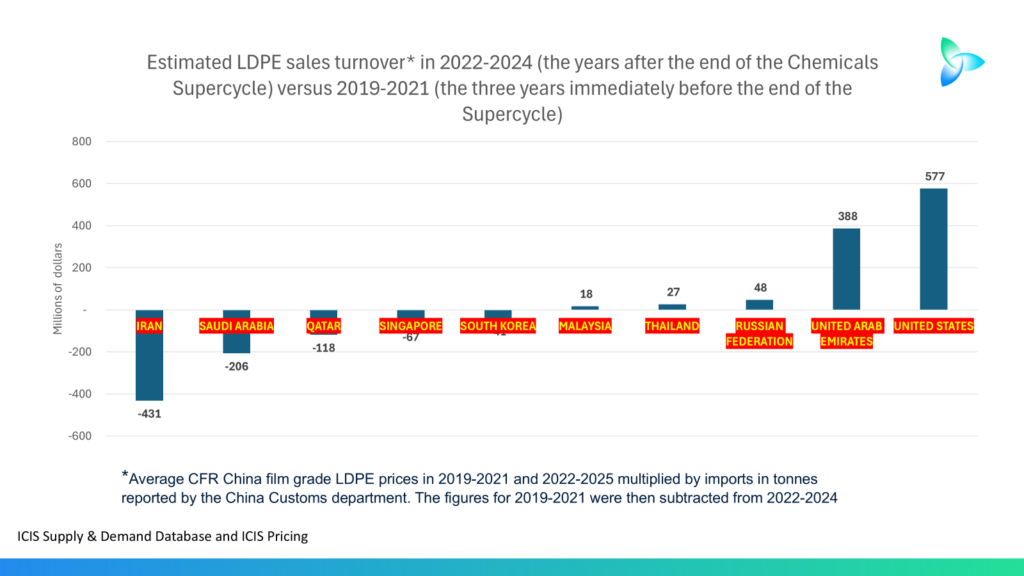

US-China LDPE in 2022-2024 versus 2019-2021

There clearly must be other factors in play than just tariffs because the US also gained ground in LDPE. This is despite our understanding that the tariff waivers described above don’t apply to LDPE.

China’s imports of US LDPE rose by 67% to 1.3m tonnes with imports from the United Arab Emirates 39% higher at 1.2m tonnes. Imports from Iran were down by 14% at 1.8m tonnes with shipments from Saudi Arabia 17% lower at 1.1m tonnes.

Unlike with HDPE and LLDPE, LDPE is not subject to the same oversupply problems. From now until 2030 there are some years when ICIS estimates that LDPE capacity will be less than global demand. This is compared with big surpluses for HDPE and LLDPE.

This is reflected in the footnote in the above table which shows a small decline in overall Chinese LLDPE imports compared with HDPE and LLDPE.

This lack of oversupply is also reflected in the chart below. Note that the ICIS margin assessments are only for film grades (did the US enjoy better margins in other grades). On this basis, as you can see, US margins have been consistently weaker than those in the Middle East since the late 2021 Evergrande Moment.

We should also take the next chart with a similar pinch of salt as our only CFR LDPE price quote in China is for film grade and of course imports include not just film grade. They also include extrusion and injection grades. But on this basis, the US showed big LDPE sales turnover gains in 2022-2024 versus 2019-2021:

- US LDPE turnover in China grew by $577m with the UAE $208m higher as Iran and Saudi Arabia declined by $431m and $206m. respectively.

Conclusion: Building scenarios and the role of AI

As always, this post gives you just a few pieces of the jigsaw puzzle.

Pieces missing from my analysis include a quick-and-easy way of tracking sales turnover gains and losses in the chemicals and polymers across all the countries and regions for each exporting country, using ICIS price quotes and the trade data.

To what extent, for instance, did Saudi Arabia make up for its lost PE ground in China through growing exports to and sales turnover in other countries and regions? Were any such gains a response to accurate forecasts of better netbacks?

How do we build scenarios around the global trade environment could be like in six months factoring in the Trump effect? What about climate change and geopolitical disruptions to supply chains and to and demand patterns?

The great thing about AI – which I believe is as important a new technology as steam power, electricity and the internet – is that it has arrived at a time of much-increased market complexity. An unsolved problem has met a new opportunity to solve the problem.

We don’t know how useful AI will be in building scenarios around the variable described above, and many other variables. We will only know if we engage with the technology because it is very, very iterative to an extent that we have never seen before.