Introduction

In recent years, the geopolitical landscape of both the Middle East and South Asia has seen significant changes because of global power shifts and a rapidly changing regional security environment. Gulf states are expanding their ties and diversifying the nature of investments across Asia, and South Asian countries have increasingly aligned strategic and economic priorities with their long-standing Gulf partners .

The recent trends of engagement between the Gulf states and South Asia should be assessed within the broader regional diversification ambitions of Gulf states as well as their attempts to increase strategic autonomy. While placed within the context of South Asia–Gulf relations, this report specifically focuses on the evolving engagements of India, Pakistan, and Bangladesh with Gulf states in recent years, assessing shared interests, mutual expectations, and regional responses.

India–Gulf Relations: Strategic Convergence and Growing Partnership

India’s ties with the Gulf states have undergone a remarkable transformation in recent years, marked by deepening economic and strategic cooperation. This growth is driven by the converging interests and priorities rooted in mutual trust. The Gulf states acknowledge India’s geopolitical weight and its unique position in the Indo-Pacific. Amid the geopolitical shifts in the Middle East, India also realizes the importance of Gulf states in regional diplomacy and maintaining security and stability, especially ever since the Gaza conflict, which has altered the regional balance of power in the Middle East.

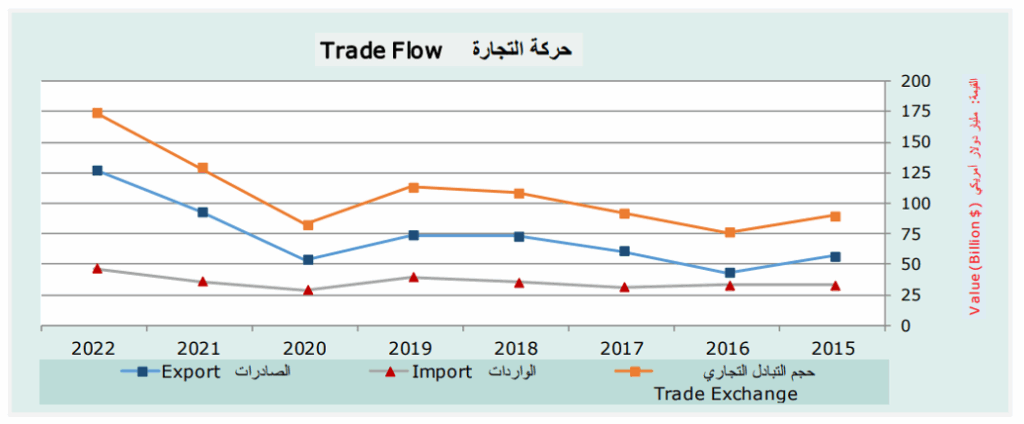

India and the Gulf states have deepened their engagement through multi-sectoral partnerships. The growing engagement now spans across trade, defense, energy, technology, space, digital infrastructure, and connectivity. India’s ties with the UAE and Saudi Arabia stand as the most expansive, diversified, and institutionalized. This is evident from the number of top-level visits made by leaders and the range and scope of agreements signed between these countries in recent years. The Gulf Cooperation Council (GCC) is India’s largest trading bloc, and New Delhi has accentuated efforts to increase trade with its Gulf partners. The Comprehensive Economic Partnership Agreement (CEPA) between India and the UAE, signed in 2022, paved the way for increasing bilateral trade between both countries. Since the signing of CEPA, bilateral merchandise trade increased from $43.3 billion in FY 2020-21 to $83.7 billion in 2023–24. The agreement effectively broadened the trade portfolio, with non-oil trade surpassing $57.8 billion in FY 2023–24, making up more than half of total trade. This suggests that CEPA has been functionally effective in easing trade flows and improving market access for both countries.

In January 2024, UAE President Sheikh Mohamed bin Zayed Al Nahyan visited India to participate in the 10th Vibrant Gujarat Summit. This was followed by Indian Prime Minister Narendra Modi’s visit to Abu Dhabi in February 2024. During Modi’s visit, he met his UAE counterpart and signed major agreements related to investment, connectivity, energy, digital infrastructure, and cultural heritage. Key financial links like UPI-AANI and RuPay-JAYWAN were also formalized to boost cross-border trade and connectivity. Such high-level political engagement shows the strategic importance of this relationship for both countries and their consistent efforts to streamline trade. Efforts to institutionalize financial and digital linkages further highlight a long-term vision for economic integration and people-to-people connectivity. India and the UAE also continue to strengthen their defense cooperation through joint military exercises, such as the newly launched ‘Desert Cyclone’. Moreover, both countries are broadening strategic cooperation into critical and innovation-driven sectors such as space exploration and AI. India is supporting the UAE’s satellite launches, training, and commercialization efforts under the 2016 ISRO–UAESA MoU. Cooperation in nuclear energy (Barakah Plant), LNG, and food security (Gujarat-ADQ food parks) further reflects the depth of engagement. UAE’s investments in smart grids, pharmaceuticals, and AI under industrial MoUs place it as a significant contributor to India’s modernization agenda.

India also has expanded its ties with Saudi Arabia. Saudi Crown Prince Mohammed bin Salman’s state visit in 2023 and Modi’s visit to the kingdom in 2025 have been pivotal in deepening the bilateral relations. The launch of the India–Middle East–Europe Economic Corridor (IMEC) during the 2023 G20 Summit reflects the shared global connectivity ambitions of both countries. IMEC has drawn significant international attention, especially amid growing threats and disruptions to traditional shipping and transport routes caused by ongoing wars in Gaza and Ukraine and maritime threats from Yemen. The India-Saudi Strategic Partnership Council (SPC) has formed ministerial committees for Defence and Tourism Cooperation, highlighting efforts toward a more structured framework. The $225 million defense export agreement and joint military drills like Al Mohed Al Hindi and SADA TANSEEQ exemplify expanding military cooperation. The continuing Saudi naval cadet training in India further reflects the strong defense ties. Both countries have also signed a space cooperation MoU in 2023, which aligns with Saudi Arabia’s aim to rise as a global hub in the space sector under Vision 2030. These developments show that India is emerging as a key strategic partner for Saudi Arabia and the UAE, anchored in long-term institutional and policy-level cooperation.

The broader India–Gulf relationship has also witnessed sustained growth in recent years. During the visit of Qatari Emir Sheikh Tamim Bin Hamad Al-Thani to India in February 2025, Qatar and India elevated their relationship to a Strategic Partnership. Both countries agreed to double bilateral trade by 2030 and signed several MoU’s including in finance, sports, investment cooperation, and revised the Double Taxation Avoidance Agreement. Both countries also signed a 20-year LNG supply pact, which is one of India’s largest-ever, ensuring 7.5 MMT per annum from 2028 to 2048. Qatar also pledged $10 billion in Indian infrastructure and tech, and both countries have advanced their fintech connectivity by launching UPI (Unified Payments Interface) in Qatar, thereby easing financial transactions for Indians residing in and travelling to Qatar. Both countries have been discussing mechanisms to enhance cooperation in sectors like food security, space, AI, security, and counterterrorism. Qatar also released eight former Indian naval officers previously sentenced to death on espionage charges in 2024, reflecting the strong political and diplomatic ties between both countries. These developments indicate that both countries are moving to a more strategic, multi-dimensional partnership which is driven by long-term energy cooperation, economic investment, and digital integration. Qatar increasingly views India as a key partner for its own economic diversification, technological advancement, and geopolitical balancing.

In recent years, India has expanded its cooperation with Oman. In December 2024, Oman hosted the 13th India–Oman Strategic Consultative Group, and both countries discussed ways to enhance cooperation in energy, defense, security, and technology. Oman and India engage in joint military exercises, like Naseem Al Bahr and Al Najah, and share a mutual interest in facilitating smoother maritime trade through greater access to each other’s ports. In December 2023, Oman’s Sultan Haitham bin Tarik visited India and met Prime Minister Modi. During the visit, both countries signed several MoUs and investment agreements under the Oman-India Joint Investment Fund (OIJIF-III). The visit also led to the adoption of the ‘India-Oman Joint Vision: Partnership for the Future’.

India has also sought to enhance its cooperation with smaller Gulf states like Kuwait and Bahrain. In 2024, Modi visited Kuwait, marking the first Indian Prime Minister to visit the country in 43 years. During his visit, he signed agreements to deepen cooperation in defense and renewable energy. India’s foreign minister, Dr. S. Jaishankar, also visited Kuwait later and discussed issues of bilateral and regional importance, including the bilateral investment treaty and the India-GCC FTA. India-Bahrain relations have also witnessed significant growth in recent years. The 4th High Joint Commission (HJC) in December 2024 identified new areas of cooperation such as space, fintech, food security, and renewable energy. RuPay’s proposed rollout and the Bilateral Investment Treaty are steps toward financial integration. Bahrain is emerging as a niche partner in fintech and energy transition, and its strategic location along key maritime routes complements India’s maritime, economic, and regional connectivity ambitions in the Gulf. These visits signal that India is actively working to broaden its engagement strategy by expanding ties with smaller yet strategically important Gulf states.

While India has traditionally maintained neutrality in regional conflicts, in recent years it has deepened and expanded its ties with Israel in technology, defense, security, and intelligence, even as New Delhi continues to support a two-state solution. This has also influenced India’s overall approach toward the region and its stance on regional conflicts and wars, as evident from New Delhi’s position on the recent Israel-Iran war. India is also engaging with Israel within broader regional initiatives like IMEC and I2U2 (India-Israel-UAE-USA). This reflects India’s measured shift from passive neutrality to strategic realignment and a more interest-driven multi-vector foreign policy with larger realpolitik considerations.

Contrary to India’s position, neither Pakistan nor Bangladesh recognize Israel and maintain no diplomatic relations with Tel Aviv – a divergence that, in the coming years, could shape and determine the nature and scope of regional-level cooperation for both, especially in connectivity initiatives that have featured Israel. However, progress in such initiatives hinges on the willingness of the Gulf states and Israel’s ability to exercise restraint, as the Gulf states s are unlikely to engage with Israel unless it stops the atrocities in Palestine and adheres to international law. India, aware of these sensitivities, is aligning itself with like-minded countries keen on accentuating regional trade and connectivity initiatives in a manner that balances its interests with prevailing geopolitical realities.

Illustration 1: India-GCC Trade Data

Pakistan’s Challenges and Its Recalibrated Approach to the Gulf

Following the brief period of political instability, Pakistan Prime Minister Shehbaz Sharif’s re-election in February 2024 set the stage for a series of high-profile engagements with key Gulf states. Amid the economic crisis and the urgent need for investments to keep the economy afloat, Pakistan has been working toward rebuilding trust and attracting foreign investment.

Shehbaz Sharif’s visit to Saudi Arabia in April 2024 was the first major diplomatic move of his second term. Sharif’s visit went beyond symbolism, as it came at a time when Riyadh was reassessing the nature of economic partnership and investments with Islamabad. Political instability had prompted Saudi Arabia to delay its previously announced $5 billion investment plan. However, Sharif’s visit resulted in agreements worth $2.8 billion and laid emphasis on strategic projects like the $10 billion oil refinery in Gwadar, suggesting a renewed willingness from the Saudi side to re-engage contingent on more stable governance.

In October 2024, Saudi Investment Minister Khalid Al-Falih visited and announced the signing of 27 agreements worth $2 billion. He also expressed Saudi Arabia’s intent to allocate a substantial portion of its $200 billion annual construction contracts to Pakistani suppliers. Trade between the two countries has witnessed an 80 percent surge, reaching $5.4 billion in 2024 compared to $3 billion in 2019. This indicates a slow yet growing momentum in Saudi-Pakistan economic engagement. However, there have been challenges and concerns for foreign investors primarily due to the political instability and policy reversals in Pakistan. Delays in the progress of Gwadar refinery and Reko Diq mining project have prompted calls for stronger legal protections and guarantees of long-term policy continuity. These challenges highlight the need for robust institutional reforms, legal safeguards, and policy stability to sustain foreign investments.

Perhaps the most enduring and insulated aspect of Pakistan-Gulf relations is their military and security cooperation, which has largely continued unaffected by political changes or geopolitical constraints. Defense cooperation between Saudi Arabia and Pakistan has been robust and anchored in mutual trust. Field Marshall Asim Munir’s visit to Riyadh in November 2024 was critical in further enhancing military coordination. Saudi and Pakistani officials met under the framework of the Joint Military Cooperation Committee (JMCC), where both sides reaffirmed shared goals related to regional security. Reflecting their converging security interests and strong strategic alignment, both countries have continued to conduct joint military exercises, including Al-Samsam (focused on counterterrorism operations), Affaa Al Sahel (naval special operations), and Al-Battaar (joint special forces exercise).

In the defense and security domain, Pakistan leads joint exercises with all its Gulf partners. The 8th International Army Team Spirit Exercise held in Kharian in 2025 involved 20 nations, including Saudi Arabia and Bahrain. Pakistan has also conducted joint military exercises, naval drills, and anti-piracy operations with Gulf states, and the latter send military and naval officers for training in Pakistani military academies, reinforcing the depth of defense collaboration. Pakistan’s military and security ties with the Gulf states can be seen as a continuation of Pakistan’s calibrated strategy to emerge as a critical regional security partner and balance its limitations with hard power leverage.

The UAE has emerged as an important partner of Pakistan, offering both economic lifelines and long-term strategic opportunities. During Sharif’s visit to Abu Dhabi in May 2024, the UAE pledged $10 billion in investments across various sectors, including ports, food security, IT, tourism, and finance, reflecting Abu Dhabi’s confidence in high-impact sectors. Both countries have taken steps to deepen cooperation in digital transformation, renewable energy, and banking. The UAE’s AD Ports Group, which has invested $400 million in Karachi Port, signed four new MoUs covering maritime, rail, air transport, logistics, and digital services. These initiatives align with the UAE’s broader interest in consolidating supply chains, accessing emerging markets, and strengthening connectivity with South Asia while offering Pakistan critical capital and infrastructure support.

Qatar has also actively supported Pakistan’s economy in recent years. During Sharif’s visit to Doha in 2024, Qatar reaffirmed a $3 billion investment pledge through the Qatar Investment Authority. Qatar has agreed to invest in Pakistan’s LNG terminals, seaports, airports, stock markets, and solar energy. Pakistan and Qatar also maintain strong energy ties, anchored in long-term LNG supply agreements, including a 10-year deal signed in February 2021. Both countries also maintain strong defense and security ties, as evident from the deployment of 4500 Pakistani troops to Qatar for security during the FIFA World Cup 2022. Pakistan-Kuwait relations have also expanded in recent years, and both countries have signed several MoUs in manpower, IT, mineral exploration, food security, energy, and defense. In 2024, Pakistan signed a $25 million loan agreement with its Water and Power Development Authority for the Mohmand Dam project, under a broader $100 million commitment from the Kuwait Fund. Both Qatar and Kuwait are emerging as key partners in shaping Pakistan’s economic and security landscape.

At the multilateral level, Pakistan achieved a significant milestone by signing a preliminary Free Trade Agreement with the GCC in September 2023. This agreement, formalized in Riyadh, represents a turning point in regional trade integration and opens new avenues for tariff-free market access. The GCC leadership described it as a platform for mutual prosperity and emphasized the importance of sustained cooperation. In June 2023, Pakistan established the Special Investment Facilitation Council to institutionalize and fast-track development and investment projects that have attracted over $28 billion from Gulf investors. These include flagship ventures such as the Diamer-Bhasha Dam, Reko Diq mining, and the Gwadar oil refinery. A Pakistan Sovereign Wealth Fund was also created in 2023 to manage capital from state-owned enterprises and support SIFC-led projects. Legal reforms now allow these investments to proceed across caretaker governments, a crucial step in addressing investor concerns over policy discontinuity. These reforms can play a key role in aligning with Gulf states’ interest in securing long-term economic footholds in the region; however, sustained stability will still depend on Pakistan’s domestic political climate and governance capacity.

Sharif participated in the Arab-Islamic Summit in November 2024 held in Saudi Arabia and reiterated his support for Palestine and condemned Israeli actions in Gaza. Pakistan has shared interests and concerns over the Palestinian issue and has been a consistent advocate for a two-state solution, actively supporting diplomatic efforts at regional and international forums. Amid the Gaza war and Israeli attacks on Lebanon, Pakistan dispatched over 1300 tons of aid and established Prime Minister’s Relief Fund for Gaza and Lebanon to collect public donations. Pakistan is a significant power in the Islamic world because of its sizable military, nuclear capability, deep-rooted religious and cultural ties, and its historical role in supporting pan-Islamic causes. This status remains key to Islamabad’s geopolitical weight, and Islamabad has often relied on this to protect its strategic interests and expand its influence in the Middle East.

Amid the rapidly changing geopolitical environment both in the Middle East and South Asia, the Gulf states have consistently maintained close ties with Pakistan, because of its military capabilities and strategic significance. For the Gulf states, Pakistan provides military assistance, strategic depth, a sizeable consumer market, and a substantial expatriate labor force. Conversely, for Pakistan, the Gulf region remains a key source of foreign direct investment, energy security, remittances, and diplomatic support on regional and global platforms.

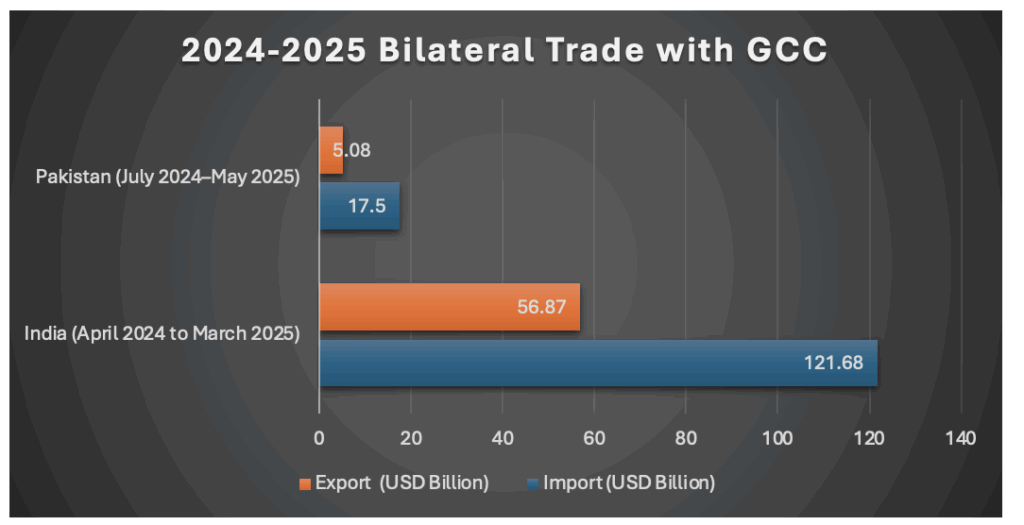

Illusatration 2: 2024-2025 Bilateral Trade with GCC

Source: Designed by the author based on primary and secondary sources

Bangladesh–Gulf Relations Amid Domestic Turmoil

Despite internal political tensions, Bangladesh has consistently sought to maintain and deepen its relations with Gulf states. These states notably refrained from making any public statements amid the domestic political turmoil that led to the fall of Sheikh Hasina and the collapse of the Awami League–led government in 2024.

In recent years, Bangladesh has diversified its partnerships with GCC across political, economic, energy, and defense domains. They have deepened cooperation in areas such as climate change, agriculture, food security, and environmental protection, while institutional mechanisms like joint working groups and business councils have been established to implement the aforesaid. This push for enhanced multilateral engagement complements bilateral efforts, as seen in Qatar’s Emir Sheikh Tamim bin Hamad Al-Thani’s landmark visit to Dhaka in April 2024. Major agreements covering maritime transport, legal affairs, taxation, port management, and labor were signed during this visit. The visit also focused on boosting skilled labor migration and attracting Qatari investments in special economic zones and sectors such as agro-processing, energy, and IT. Energy security remains a cornerstone of Bangladesh’s relations with the Gulf. A 15-year agreement signed with QatarEnergy will see Bangladesh import up to 1.8 million tonnes of LNG annually starting in 2026, building on an earlier 2017 deal under which over 11.7 million tonnes have already been delivered. This long-term energy partnership is vital to Bangladesh’s ambitions to meet rising domestic demand while ensuring sustainable economic growth. During Emir Sheikh Tamim’s visit to Dhaka, new defense agreements were signed, including the deployment of 1129 Bangladeshi military personnel to Qatar. Bangladesh, with its long-standing peacekeeping experience under the UN, is viewed as a reliable security partner. Bangladesh is also actively engaged with the GCC-led Islamic Military Counter-Terrorism Coalition (IMCTC), through which it cooperates with Saudi Arabia and other regional actors on intelligence sharing, joint training, and counter-terrorism strategy.

Apart from the long-standing energy ties, Dhaka aspires to expand its trade with its Gulf partners. In this regard, Saudi Arabia and the UAE are expected to emerge as important markets for Bangladesh’s textile industry, and recent meetings indicate efforts to identify potential sectors to deepen cooperation. Bangladesh’s garment exports to Saudi Arabia increased from $130 million in FY 2022–23 to $152 million in FY 2024–25, marking a 7.3 percent year-on-year growth. The “Dubai-Bangladesh Business Briefing” in February 2025 saw high-level business delegations from both sides discuss investments in logistics, fintech, renewable energy, healthcare, and tourism. The event led to a new MoU between the Dhaka Chamber of Commerce and Industry (DCCI) and Dubai Chambers, focusing on joint ventures, trade fairs, and business matchmaking. There has also been significant progress in Saudi Arabia-Bangladesh defense and security cooperation. Bangladesh and Saudi Arabia held their inaugural Joint Committee on Defence Cooperation in Dhaka in May 2025, marking a key milestone in formalizing military ties.

Saudi Arabia has in recent years taken several measures to increase its foreign investment in Bangladesh’s renewable energy projects. A joint venture led by Saudi-based ACWA Power Company set up Bangladesh’s largest solar power plant in Rampal with an investment of $430 million in 2023, marking a major step in the country’s transition to clean energy. Similarly, in 2025, UAE-based renewable energy firm Masdar proposed a $500 million investment to build a 250 MW coastal solar power project in Bangladesh. Dahaka has introduced a 10-year tax exemption policy for renewable energy projects. The new policy offers 100% tax relief in the first five years for projects commencing commercial operations by mid-2030, significantly enhancing investor incentives.

Amid efforts to boost foreign investment, maintain domestic stability, and manage broader regional dynamics such as the India-China rivalry, Bangladesh remains keen on identifying potential areas to deepen its cooperation and position itself as a proactive partner in the Gulf’s long-term economic and security frameworks.

Converging Priorities Amid Regional Conflicts and Great Power Rivalries

In an era marked by regional and global geopolitical challenges, and security risks to traditional shipping routes, Gulf states and South Asian countries have several converging priorities. It is in the interest of both to ensure safety and stability in the western periphery of the Indian Ocean Region through which the majority of energy supplies are transported, and a bulk of energy exports of Gulf states transit. India, particularly, as a major energy importer and rising maritime power, has a vital interest in safeguarding critical sea lanes, especially the Strait of Hormuz and Bab el-Mandeb. This remains a priority for India not just to secure its energy flows, but also as part of its broader commitment to regional stability and cooperative security frameworks in the region.

India and Pakistan have strategic interests in the Middle East, which are often challenged by regional conflicts and wars. Amid the Gaza war and the escalations in Lebanon, Syria, and Yemen, Gulf states like Saudi Arabia, Qatar, and the UAE have emerged as influential actors in regional affairs, capable of shaping political outcomes, mediating disputes, and leveraging their power for strategic influence as well as maintaining peace and stability. This further underscores the importance for South Asian countries to deepen their engagement with the Gulf states. A notable feature of Gulf diplomacy has been its strategic hedging, and the Gulf states have adopted a pragmatic approach in their relations with major powers, seeking to avoid alignment with any single bloc, thereby enabling them to engage more flexibly.

As the global order shifts toward greater multipolarity, countries across the Gulf and South Asia are increasingly embracing diversification in their strategic partnerships, seeking to balance traditional alignments with new diplomatic and economic engagements. The regional powers of the Middle East and South Asia have converging interests in reducing risks associated with US-China rivalry and increasing their strategic autonomy. This trend reflects a mix of realpolitik considerations and status-seeking behavior, as many of these states pursue middle power diplomacy to enhance their global power stature and influence.

It is increasingly evident that there is a shared interest among Gulf and South Asian powers to reshape the contours of the international order, prioritizing multipolarity. Moreover, they have been vocal in advocating for a more equitable global governance system that reflects the aspirations of the Global South. This shared posture has translated into deeper political dialogue, expanded economic cooperation, and enhanced security coordination.

Mutual Expectations and Shared Interests

Gulf states and South Asia have enjoyed historic ties rooted in centuries of cultural exchange, trade, and migration. This has evolved into complex partnerships encompassing energy cooperation, labor mobility, and strategic dialogue.

The Gulf states and South Asian countries enter partnerships with distinct but increasingly complementary expectations shaped by strategic considerations, economic ambitions, and geopolitical underpinnings. For the Gulf states, South Asia offers a vast consumer market, a long-standing dependable source of labor, and a key partner for diversifying investment portfolios and supply chains. As a part of their domestic reform initiatives, Gulf states are also seeking to export their capital and diversify from Western markets, secure food and energy corridors, invest in digital infrastructure in rising economies, and gain geopolitical depth through defense partnerships. In this context, countries like India and Pakistan remain significant.

Conversely, South Asian countries regard the Gulf as crucial partners for ensuring energy security, enhancing defense cooperation, and collaboration in key sectors like defense, fintech, space, and connectivity. South Asia also looks to the Gulf for diplomatic support in multilateral forums.

The Gulf states are among the top sources of remittances for India, Pakistan, and Bangladesh. In 2023–24, India and Pakistan received approximately $35 billion and $21 billion, respectively, in remittances from Gulf states, underscoring the Gulf region’s vital role in sustaining South Asia’s foreign income flows. Moreover, the ongoing discussions regarding a possible Free Trade Agreement (FTA) reflect the long-term economic considerations for Gulf and South Asian countries, which could further boost trade ties.

The Gulf States’ Neutrality and Growing Diplomatic Influence

Given the deep economic stakes between the Gulf states and South Asia, it is imperative for the Gulf states to uphold greater responsibility in maintaining neutrality and fostering stable relations across the region. This approach is crucial to ensure that their investments and long-term agreements remain insulated and protected from the volatility of regional tensions and rivalries.

In South Asia, the Gulf states have maintained a neutral stance in regional conflicts. For instance, during periods of heightened India–Pakistan tensions, Gulf states refrained from overtly siding with either party. In 2019, following India’s airstrikes in Pakistan, the UAE and Saudi Arabia intervened diplomatically to de-escalate tensions. The UAE’s foreign minister visited both countries, while Saudi Arabia engaged with their leaders. In 2021, the UAE facilitated secret talks in Dubai, leading to a joint India-Pakistan ceasefire agreement along the Line of Control. Amid the India-Pakistan military escalations in May 2025, Saudi Arabia offered its good offices to de-escalate tensions. Saudi Minister of State for Foreign Affairs Adel Al-Jubeir visited India and Pakistan to help de-escalate tensions between the two countries. These efforts reflect increasing diplomatic maneuvers of countries like Saudi Arabia and the UAE in the region because of their close relations with both India and Pakistan.

The Gulf states have also shown a pragmatic approach toward domestic political changes in countries like Pakistan and Bangladesh. During the political upheaval that led to the fall of Prime Minister Sheikh Hasina in August 2024, they maintained a cautious approach. No official statements indicative of taking any political sides were issued, reflecting a pragmatic diplomatic posture. A similar response was adopted even during political instability in Pakistan after the fall of Imran Khan. This approach is indicative of two key considerations. First, the Gulf states tend to avoid making categorical responses on the domestic political affairs of friendly countries unless their core strategic interests are directly affected. Second, they enjoy long-standing institutional relationships that highlight the fact that bilateral relationships transcend individual political leadership. Hence, the approach of the Gulf states can be seen to be a calibrated decision to maintain neutrality and preserve bilateral ties regardless of political transitions. Additionally, the continuity of military cooperation and economic ties during periods of domestic upheavals indicates that the Gulf states are primarily focused on maintaining stability and enhancing their long-standing ties.

It is important to note that the Gulf states, especially Saudi Arabia and the UAE, have always condemned acts of terrorism, including terror attacks in Pakistan, India, Sri Lanka, and Bangladesh. Taking into consideration the nature of polarized opinions in South Asian countries and regional volatilities, their responses have usually been cautious and measured in times of regional tensions and crises.

Conclusion

The Gulf states’ consistent adherence to a policy of non-interference and political neutrality has been instrumental in sustaining stable relations with South Asian countries, regardless of their internal political developments. By emphasizing pragmatic cooperation over political alignment, both sides have managed to preserve and deepen their partnerships amid shifting domestic and regional dynamics. As Gulf states and South Asian countries deepen their ties, their ability to influence regional outcomes without being affected by great power rivalries will be tested. Moreover, as economic diversification and expansion are key agendas for both regions, it is likely that the partnerships will now focus more on ensuring and enhancing institutional resilience. Key actors from both regions share a strong commitment to ensuring security and stability, with maritime safety and connectivity projects as central to their strategic priorities. The emerging regional order will reward those actors who are in a better position to engage constructively with all stakeholders to protect their strategic interests, and hence it will be critical for countries like India and Pakistan to respond to the shifting balance of power in the Middle East carefully. In this context, the evolving Gulf-South Asia engagement reflects not just economic pragmatism but also a recalibration of strategic alignments. Taking into consideration South Asia’s fiscal challenges, strengthening engagement with the Gulf will be crucial for attracting investment, enhancing energy security, and diversifying partnerships, potentially redefining regional interdependence and shaping new development trajectories.

![]()